The US may be headed for a recession soon. In order to bring down inflation to tolerable levels, the Federal Reserve will probably have to raise interest rates enough to induce a recession by the end of 2023.

Since the dollar went off the gold standard, the US has never come down from high inflation without going into recession. It’s true that inflation has only been as high as it is now a few times before. When it was this high, the economic situation was very different than it is now, so we probably shouldn’t draw too strong conclusions from that history. This could turn out to be the first time we manage to bring high inflation down without a recession. It’s just not the way to bet.

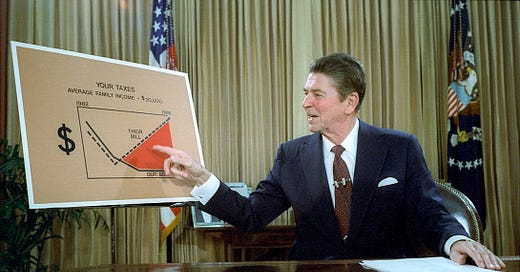

Consumer prices in the US increased more than 8% over the last year. That’s the fastest increase in prices since Ronald Reagan’s first year in office. It means that even though our nominal wages have been increasing rapidly, we’re effectively making less money than we were a year ago.

We are, understandably, not happy. Inflation erodes the value of both the money we make and the money we’ve saved. In general, the economy requires more or less stable prices to function tolerably well. When inflation runs more than a couple of percent, ordinary transactions become difficult and risky. A recent FiveThirtyEight/Ipsos poll found more than half of Americans—both Democrats and Republicans—say inflation is the most important issue facing the country.

High inflation like this arises because of a mismatch between supply and demand. When the COVID-19 pandemic hit, the supply of things to buy fell dramatically, while the demand for them stayed high as pandemic stimulus made up for—and eventually more than made up for—income lost to the pandemic. The disruption to supply caused by the Russian invasion of Ukraine exacerbates the situation, but most of last year’s price increases actually occurred before the invasion began.

The main thing the Federal Reserve can do to lower inflation is to slow the economy. Central banks like the Fed can’t do much to increase supply, but they can reduce demand by raising interest rates. Raising interest rates increases the cost of borrowing and—by extension—the cost of spending money. As sales slow, businesses lose their ability to raise prices. In theory, it might be possible for the Fed to achieve a “soft landing”—to slow the economy enough to rein in inflation without putting people out of work or making it hard for them to find jobs. Fed Chair Jerome Powell thinks there are—at least in principle—“pathways” to a soft landing. Those pathways probably exist only to the extent that inflation is in some sense transitory. If the things that reduce supply—like shortages caused by the pandemic and the invasion of Ukraine—and the things that increase demand—like excess savings and high government spending—simply fade away, then inflation might return to relatively normal levels essentially on its own. The Fed could bring interest rates up to a level that doesn’t either slow or stimulate the economy, and then just get out of the way.

But there’s reason to believe that some of the factors contributing to the current surge in inflation aren’t transitory. While the US GDP fell in the first quarter of this year as faltering overseas economies imported less from the US, American spending—which is relatively consistent from quarter to quarter—continued to increase. If the global economy continues to slow, the GDP could fall again in the second quarter, but underlying demand in the US seems like.y remain high. Businesses continued hiring—there are now something like two openings for every person looking for work—with unemployment falling to just 3.6%. Wages rose, as businesses had to pay more to attract and retain employees.

That means the Fed will probably have to induce a recession to bring inflation down. Unless the current spike in inflation is really caused by transitory, short-term factors, bringing it down may require the economy not merely to slow but to shrink, to the point that people simply can’t afford to pay higher prices. The pain that a slowing economy causes is precisely what brings inflation down. There’s no real precedent in any case for bringing inflation down from over 8% without causing a recession. The Fed has tried to reduce inflation by rapidly raising rates nine times since 1961, but managed to avoid causing a recession only one of those times. The one time it succeeded was in 1994 when inflation was much lower than it is now. As Jason Furman said in a recent interview, “It’s hard to imagine how we get back to 2 or even 3 percent without a recession.”

The Fed’s “dual mandate” means that in theory it’s supposed to keep both inflation and unemployment low. The Fed appears to be hoping that inflation will go away this year while it begins to raise rates so it doesn’t have to choose between the two priorities. But the Fed is clearly willing to trade off a fair amount of higher unemployment for lower inflation. High inflation tends to become a self-reinforcing cycle—prices go up because we demand to be paid more in anticipation that prices will go up—and may eventually lead to higher unemployment as well. As it is, inflation means we can buy less even though we’re nominally earning more. If there’s any doubt about the Fed’s priorities, Powell has made clear that failing to stabilize prices is “the one thing we really cannot do” because high inflation “doesn’t work for anybody.”

The US has recessions, on average, about one in every seven years. The fact that the Fed is raising rates rapidly now—and that it will probably try to get inflation down to close to 2%—dramatically increases the chances of a recession next year, even though the economy is strong by many measures right now. In addition, if GDP falls again this quarter—which is possible, although I don’t see any strong reason to expect it to do so—the US will be in a recession simply by virtue of having two down quarters in a row. Metaculus currently estimates there’s a 75% chance the US goes into recession by the end of 2023. As I wrote recently, I don’t expect inflation to fall dramatically this year. It seems unlikely to me it will come down enough to keep the Fed from raising rates further. That makes a recession by the end of 2023 likely.

My Forecast

68% chance the US goes into recession by the end of 2023

Last week we started fostering two three-week old kittens through the Hawaiian Humane Society. More animals come into shelters during kitten season than they have capacity to take in. If you’re able to foster, I can’t recommend the experience highly enough. It really does save lives.